Overview of EOBI Login 2025

The EOBI Login 2025 Benefits Institution, commonly known as EOBI, is a national social security organisation established to provide financial protection to private-sector employees after retirement. It is a mandatory pension system designed for registered employees and employers, ensuring that workers receive lifelong financial assistance once they reach retirement age. By collecting contributions from both employees and employers, EOBI creates a fund that later supports individuals through pensions, invalidity benefits, and survivors’ pensions. This system helps retired workers maintain stability and financial dignity in their later years.

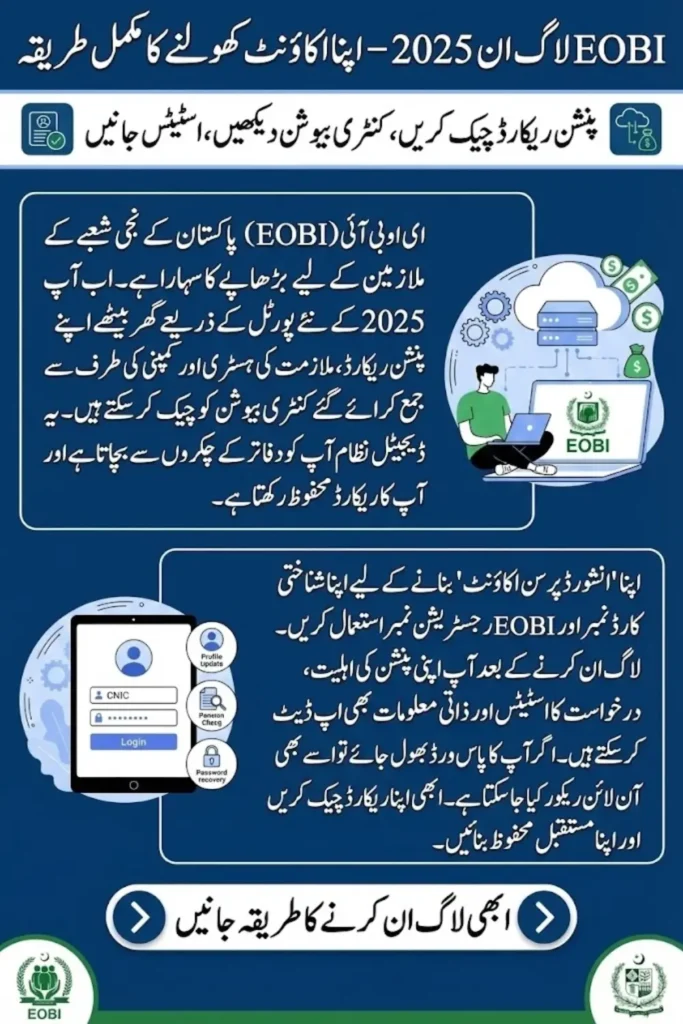

EOBI plays a vital role in improving the overall welfare of workers in Pakistan’s private sector. As industries continue to grow, millions of employees rely on EOBI to secure their future. The introduction of the digital EOBI portal has made the system more efficient and transparent. It enables insured individuals to view their records, verify contributions, check pension status, and manage their accounts online, eliminating the need to visit offices. The purpose of EOBI is to ensure every registered worker has access to financial security, accurate records, and long-term retirement support.

You Can Also Read: BISP 8171 Payment Not Showing? Complete Guide to Check, Verify & Resolve Missing Payments 2025

What Is the EOBI Insured Person Account?

An EOBI Insured Person Account is an online profile created by registered workers to access their employment and contribution details. This account makes it easy for individuals to monitor their pension eligibility and track contributions throughout their career.

Key features include:

- Viewing the contribution history submitted by employers

- Checking pension eligibility status

- Accessing employment records

- Updating personal information

- Tracking claim and registration status

This online account keeps employees informed and ensures transparency in pension processing.

You Can Also Read: BISP 8171 Wallet & SIM Registration Made Simple – Verify and Activate Your Account

Benefits of Using the EOBI Online Login System

The online login system provides convenience, accuracy, and quick access to important data. It has eliminated the need for physical visits and long waiting times.

Main benefits include:

- Instant access to employment and contribution history

- Ability to check pension application status

- Secure digital record-keeping

- Easy correction of personal details

- 24/7 access from mobile or computer

- Reduces errors caused by paperwork

- Helps detect missing or incorrect employer contributions

The login system empowers insured persons to stay updated about their EOBI records at all times.

You Can Also Read: Ehsaas Program Registration 8171 2025 – Complete NADRA Guide for Beneficiaries

Eligibility for Creating an EOBI Online Account

Only certain individuals can create an EOBI online account. These conditions help ensure that only legitimate workers access the system.

Eligibility requirements include:

- Being a registered EOBI insured person

- Having a valid EOBI registration number

- CNIC must be active and valid

- Employment under a registered employer

- Verified contributions made by the employer

Meeting these conditions ensures smooth account creation and access to full benefits.

You Can Also Read: EOBI Insured Person Login 2025 – Verify Details and Track Pension Payments

Required Information to Access Your EOBI Account

To log in or create an account, insured persons must provide accurate identification details. These details help verify the person’s identity and link them to their official EOBI record.

Required information includes:

- Valid CNIC number

- EOBI registration number

- Date of birth

- Registered mobile number

- Employer name or establishment code

- Email address for notifications

Having the correct information ready makes the login and account setup process easy and quick.

You Can Also Read: BISP 8171 Wallet Account SIM 2025 – Complete Guide to Get and Activate Your Free SIM

How to Create an EOBI Insured Person Account?

Creating an insured person account is simple and requires only basic details. The online portal guides users through each step to ensure accuracy.

Steps include:

- Open the EOBI online portal

- Select the registration or signup option

- Enter CNIC, date of birth, and registration number

- Provide your mobile number and verify it through code

- Create a secure password

- Submit and activate your account

After completing these steps, you gain full access to your online EOBI profile.

You Can Also Read: Punjab Chief Minister Approves Exclusive Honorary Card for Imam Masjid Sahib

EOBI Login 2025 – Step-by-Step Guide

The login process for 2025 has been made more user-friendly and secure. It ensures that insured persons can access their accounts without complications.

Follow these steps:

- Visit the EOBI login page

- Enter your CNIC or user ID

- Type your password

- Complete the captcha

- Press the login button

- Access your dashboard with full account details

Logging in takes only a few seconds and provides complete access to your pension records.

You Can Also Read: Eobi Login Portal: Simple Steps to Register, Access the Official Portal

How to Recover Your EOBI Password or User ID?

If you forget your login details, you can easily recover them through the portal’s recovery system. This ensures uninterrupted access to your EOBI information.

Recovery steps include:

- Open the password recovery section

- Enter CNIC and registered mobile number

- Receive a verification code

- Create a new password

- For a forgotten user ID, enter CNIC to retrieve it

The recovery system ensures that you never lose access to your EOBI account.

You Can Also Read: BISP 8171 New Card Launch 2025 – Complete Guide to Apply, Activate & Receive Payments

How to Check Your EOBI Employment History & Contribution Record?

Your contribution record is the backbone of your EOBI pension. Checking it regularly ensures that your employer has submitted accurate contributions.

Steps to check:

- Log in to your insured person account

- Open the contribution history section

- View monthly contribution details

- Cross-check employment periods

- Download the record if needed for verification

- Report any missing entries to the EOBI office

Regular monitoring helps secure your pension rights and ensures contribution accuracy.

You Can Also Read: BISP 8171 2025 Verification & Eligibility Guide – Step-by-Step Process to Secure Your Cash Assistance

How to Verify Your EOBI Registration Status Online?

Verifying registration helps you confirm whether you are officially part of the EOBI system. It is an essential step for pension eligibility.

Verification steps include:

- Visit the registration verification page

- Enter CNIC and EOBI registration number

- Submit the details

- View your registration confirmation status

Quick online verification confirms that you are an active insured person.

You Can Also Read: 8171 SIM Check 2025 – Complete Guide to Verify, Secure & Protect Your Mobile Number

EOBI Pension Status Check – Complete Process

After applying for a pension, applicants can track the status to ensure their process is moving smoothly. The online portal makes this tracking simple.

Follow these steps:

- Log in to the portal

- Open the pension status or claim tracking section

- Enter claim details if needed

- View approval stage, pending issues, or final status

- Download the status record for reference

The pension status check helps retirees stay informed about their application progress.

You Can Also Read: BISP 8171 Payment Not Showing? Complete Guide to Check, Verify & Resolve Missing Payments 2025

Common Login Issues & How to Fix Them

Users sometimes face login difficulties due to technical or personal entry errors. Identifying the issue helps resolve it quickly.

Common issues and solutions include:

- Incorrect CNIC: Re-enter correctly

- Wrong password: Reset using recovery option

- Account locked: Try again after a few minutes

- Browser issues: Clear cache or change browser

- Mobile number mismatch: Update mobile number in profile

- Server downtime: Try again later

Most problems can be resolved instantly by correcting minor errors.

You Can Also Read: BISP 8171 Wallet & SIM Registration Made Simple – Verify and Activate Your Account

Important Updates to the EOBI Portal for 2025

The portal was upgraded in 2025 to improve speed, accuracy, and user convenience. These updates support better service delivery for insured persons.

Latest updates include:

- Faster account login system

- Enhanced contribution tracking module

- Improved security features

- Updated pension calculation tools

- New alerts for missing contributions

- Mobile-friendly interface

- Error-free digital record synchronisation

These updates ensure a smoother and more transparent experience for all users.

You Can Also Read: Ehsaas Program Registration 8171 2025 – Complete NADRA Guide for Beneficiaries

Frequently Asked Questions

Who can create an EOBI insured person account?

Any registered EOBI employee with a valid CNIC and registration number can create an account.

How can I check my EOBI pension status?

Log in to your account and open the pension tracking section to view updates.

What should I do if contributions are missing?

Contact EOBI or your employer to correct the missing entries.

Can I update my mobile number?

Yes, you can update it through your profile settings after verification.

Is the online EOBI login available 24 hours?

Yes, the portal is accessible anytime from any device.

You Can Also Read: EOBI Insured Person Login 2025 – Verify Details and Track Pension Payments

Conclusion – Key Takeaways for EOBI Users

EOBI is a vital support system for employees in the private sector, ensuring they receive financial protection after retirement. The online portal introduced in recent years has made the process faster, safer, and more transparent. Through your insured person account, you can monitor contributions, check pension eligibility, view employment history, and stay updated on all important records.

Every user should create an account, verify their details regularly, and monitor contributions to avoid complications at retirement time. With the upgraded portal and digital tools available in 2025, accessing your pension information has never been easier. Staying informed and proactive will help you secure your pension benefits without delay.

You Can Also Read: BISP 8171 Wallet Account SIM 2025 – Complete Guide to Get and Activate Your Free SIM