Introduction to the Parwaz Card Registration Portal

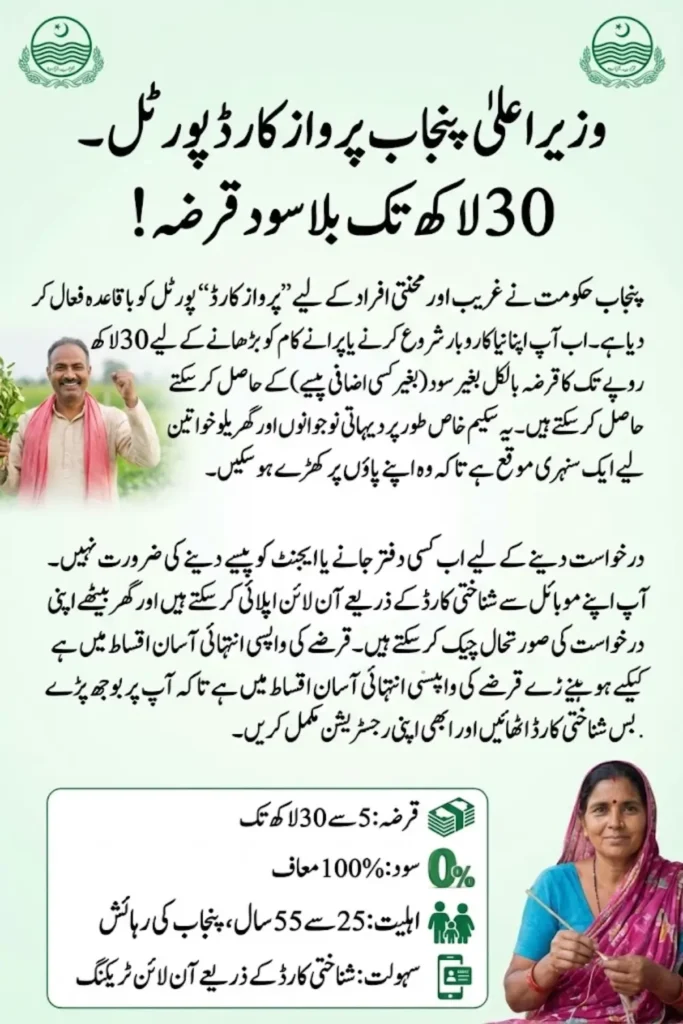

The Government of Punjab has officially activated the Parwaz Card Registration Portal to provide citizens with a transparent and digital way to apply for and track interest-free business loans. This initiative aims to promote entrepreneurship, self-employment, and small business growth through an online platform that eliminates paperwork and intermediaries.

With CNIC-based access, applicants can now monitor their application status from home without visiting any government office. The portal reflects the Punjab government’s focus on digital governance and economic inclusion, especially for youth, women, and small business owners.

Key highlights of the portal include:

- Fully online registration and tracking system

- CNIC-based login for secure access

- Real-time application status updates

You Can Also Read: Punjab Parwaz Card Registration Portal 2026: Interest-Free Business Loans, Skill Development

What Is the CM Punjab Parwaz Card Program

The CM Punjab Parwaz Card Program is a government-backed financial initiative that provides interest-free loans under the concept of Qarz-e-Hasna. The program is designed to help individuals start new businesses or expand existing ones without the burden of bank interest.

Through the Parwaz Card Portal, eligible applicants can apply digitally and receive financing based on their business needs and eligibility tier. The system ensures fairness by using automated verification and official government databases.

The program mainly supports:

- Youth-led startups and self-employment

- Women-owned and home-based businesses

- Small and medium enterprises

- Environment-friendly business projects

You Can Also Read: Punjab Supervisor Educational Scholarships: Rs. 6 Million Released for 78 Students: Know Details

Key Updates of the Parwaz Card Registration Portal

The Parwaz Card Portal offers multiple advantages compared to traditional loan systems. Its digital nature speeds up processing while ensuring transparency at every stage of the application.

| Category | Details |

|---|---|

| Program Name | CM Punjab Parwaz Card 2026 |

| Launched By | Chief Minister Punjab Maryam Nawaz |

| Purpose | Provide interest-free business loans to promote entrepreneurship and self-employment |

| Loan Type | Interest-free (Qarz-e-Hasna) |

| Maximum Loan Amount | Up to PKR 30 lakh (3 million) |

| Loan Categories | Tier 1 (up to PKR 5 lakh, no collateral) and Tier 2 (up to PKR 30 lakh, collateral required) |

| Eligible Applicants | Punjab residents aged 25–55 with CNIC, NTN, and viable business plan |

| Priority Groups | Youth, women entrepreneurs, startups, SMEs |

| Application Method | Fully online through the Parwaz Card Registration Portal |

| Tracking System | CNIC-based online application status tracking |

| Verification Process | CNIC, tax, and business verification through NADRA and government systems |

| Registration Fee | Completely free |

| Main Benefits | Easy access to finance, digital transparency, job creation, poverty reduction |

Applicants benefit from a structured loan system that focuses on financial relief and long-term sustainability. The portal also allows users to track progress without relying on agents or unofficial sources.

Major benefits include:

- 100% interest-free loans with zero markup

- Loan amounts up to PKR 30 lakh

- Flexible repayment with grace period

- Online application and CNIC-based tracking

You Can Also Read: Parwaz Card Registration Portal 2026 – Complete Guide to Interest-Free Loans and Online Registration

Eligibility Criteria for Parwaz Card Application

To ensure that financial assistance reaches deserving individuals, the Parwaz Card Program has defined clear eligibility criteria. Applicants must meet these conditions before applying through the portal.

CM Punjab Parwaz Card Portal 2026

Program Overview

Digital interest-free loan system

- Qarz-e-Hasna based financing

- Supports entrepreneurship

- Paperless online system

Who Can Apply

Clear eligibility for fair access

- Punjab residents only

- Age 25 to 55 years

- Valid CNIC and NTN required

Loan Limits

Flexible tiers for business needs

- Tier 1 up to PKR 5 lakh

- Tier 2 up to PKR 30 lakh

- Collateral for Tier 2 only

Online Application

Simple CNIC-based registration

- Register with CNIC and mobile

- OTP verification system

- Upload documents online

Application Tracking

Real-time status updates

- CNIC-based login

- Dashboard status view

- SMS and portal alerts

Required Documents

Complete papers for fast approval

- CNIC and NTN certificate

- Business plan

- Utility bill and collateral if needed

Quick Actions / Key Points

- Apply only through official portal

- Do not pay agents or middlemen

- Use accurate CNIC and contact details

- Regularly check application status

The eligibility process is digitally verified, which reduces chances of error or misuse. Providing accurate information is essential for successful approval.

Basic eligibility requirements are:

- Permanent resident of Punjab

- Age between 25 and 55 years

- Valid CNIC issued by NADRA

- Active NTN and tax filer status

- Clean credit history and viable business plan

You Can Also Read: CM Parwaz Card Know Eligibility Criteria Latest Update 2026 Know Full Details Step By Step

Parwaz Card Loan Categories and Limits

The Parwaz Card Program offers different loan categories to meet the needs of startups and established businesses. Applicants can select a tier based on their financial requirements and business scale.

Each category has its own conditions, ensuring that funds are distributed responsibly. Choosing the correct tier improves approval chances.

Loan categories are summarized below:

| Loan Tier | Loan Amount | Collateral Requirement | Suitable For |

|---|---|---|---|

| Tier 1 | Up to PKR 500,000 | Not required | Startups and small traders |

| Tier 2 | PKR 500,000 – 3,000,000 | Required | SMEs and expanding businesses |

Step-by-Step Application Process on Parwaz Card Portal

The Parwaz Card application process is fully online and user-friendly. Applicants can complete their registration using a CNIC and a registered mobile number.

Once logged in, users are guided through each step of the application form. The portal allows corrections before submission, reducing the risk of rejection.

Application steps include:

- Visit the official Punjab government portal

- Register using CNIC and mobile number

- Verify identity through OTP

- Select loan category and fill application

- Upload the required documents and submit

You Can Also Read: Parwaz Card Loan for Overseas 2025–2026: Complete Eligibility, Registration Portal & Online Application

Simple CNIC Method to Track Application Status

One of the most useful features of the Parwaz Card Portal is the CNIC-based application tracking system. Applicants can check their status online without contacting any office.

The tracking dashboard shows real-time updates, making the process transparent. This system helps applicants stay informed and take timely action if additional information is required.

Status tracking steps are:

- Log in to the Parwaz Card Portal

- Enter CNIC credentials

- Open the application dashboard

- View current status and instructions

You Can Also Read: Parwaz Card Apply Online 2026 – Complete Step-by-Step Registration Guide, Eligibility, Benefits

Application Verification and Approval Process

After submission, applications go through a structured verification process. Government systems cross-check CNIC, tax, and business details to ensure eligibility.

Applicants are notified through SMS and the portal dashboard. Approved applicants receive guidance on loan disbursement and repayment terms.

Verification stages include:

- CNIC verification through NADRA

- Financial and credit assessment

- Eligibility confirmation

- Approval or rejection notification

Required Documents for Smooth Approval

Submitting complete and correct documents is essential for quick approval. Incomplete or incorrect uploads may delay the process. Applicants should prepare documents in advance to avoid unnecessary issues during verification.

Document requirements are shown below:

| Document | Purpose |

|---|---|

| CNIC | Identity and residency verification |

| NTN Certificate | Tax compliance confirmation |

| Business Plan | Feasibility assessment |

| Utility Bill | Address verification |

| Collateral Documents | Required for Tier 2 loans |

Important Guidelines for Applicants

The Parwaz Card Program is completely free and managed through official channels only. Applicants must stay alert to avoid fraud or misinformation. Following official instructions increases the chances of successful approval and timely processing.

Important guidelines include:

- Do not pay agents or intermediaries

- Apply only through official portals

- Use accurate CNIC and contact details

- Regularly check portal updates

Final Overview

The activation of the Parwaz Card Portal marks a significant step toward digital financial inclusion in Punjab. By offering interest-free loans and CNIC-based tracking, the government has simplified access to business financing.

This initiative not only supports entrepreneurship but also strengthens trust in digital governance. Eligible citizens are encouraged to apply responsibly and use the portal features to stay informed throughout the process.

You Can Also Read: Punjab Parwaz Card Registration Portal 2026: Interest-Free Business Loans, Skill Development

FAQs

What is the Parwaz Card Portal used for?

It is used to apply for and track interest-free business loans online through CNIC verification.

Can I track my Parwaz Card application using CNIC?

Yes, the portal allows real-time application tracking through a CNIC-based login system.

Is there any fee for Parwaz Card registration?

No, the application process is completely free and does not require any payment.

Who is eligible for the Parwaz Card Program?

Punjab residents aged 25 to 55 with a valid CNIC, NTN, and a viable business plan are eligible.

How long does the verification process take?

The verification time varies, but digital processing ensures faster decisions than traditional systems.

You Can Also Read: CM Punjab Parwaz Card Registration Portal Login 2026: Official Status, What’s Fake